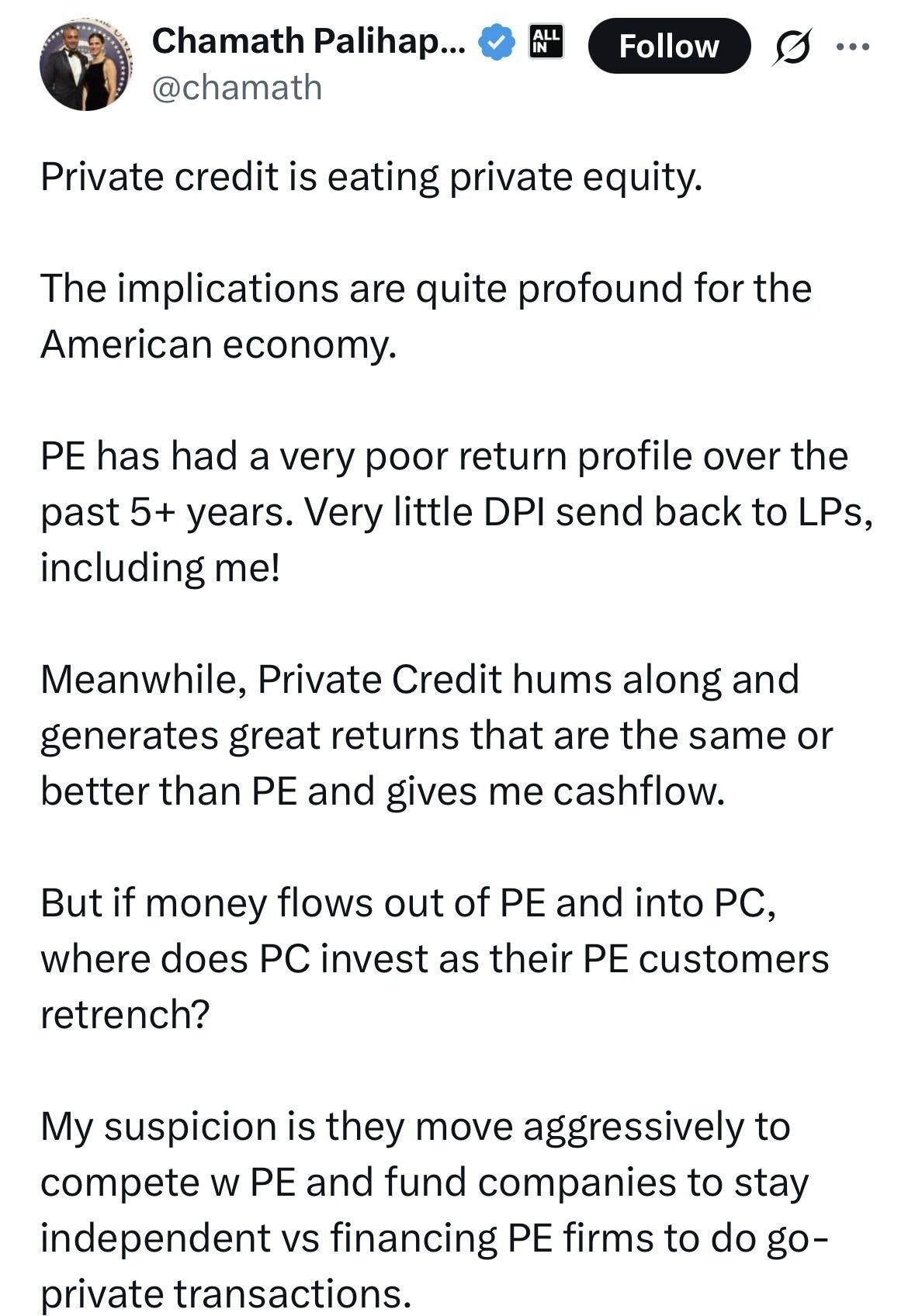

Private Credit is Eating Private Equity

Private Credit is Eating Private Equity.

Good quote by CP. I certainly don’t agree with everything he says but based on what we see in our own portfolio I find that statement to hold true.

And this is exactly why we (myself and the Dominion Capital Family Office) partnered on a real estate private credit strategy eight years ago. The steadier stable private credit returns were likely to eventually overrun the more volatile equity/private equity returns over a longer period of time (Howard Marks writes on this as well).

And I am sure this will be a topic at Milken Institute this week and SuperReturn in June.

And too CP's point if private credit grows more than the equity side (i.e. less PE capital for acquisitions), than where does the debt/credit capital go…

Well, if you follow me you are well aware of the wall of maturities, a massive gap in the capital stack, and how bank mergers and regulation are all leading to a massive need for private credit within the commercial and residential real estate sector.

The opportunities are there and we’ll keep capitalizing on them.

As usual this is not investment advice, merely boots on the ground observations from a real estate private credit specialist.

Follow Sean Kelly-Rand on LinkedIn

Good quote by CP. I certainly don’t agree with everything he says but based on what we see in our own portfolio I find that statement to hold true.

And this is exactly why we (myself and the Dominion Capital Family Office) partnered on a real estate private credit strategy eight years ago. The steadier stable private credit returns were likely to eventually overrun the more volatile equity/private equity returns over a longer period of time (Howard Marks writes on this as well).

And I am sure this will be a topic at Milken Institute this week and SuperReturn in June.

And too CP's point if private credit grows more than the equity side (i.e. less PE capital for acquisitions), than where does the debt/credit capital go…

Well, if you follow me you are well aware of the wall of maturities, a massive gap in the capital stack, and how bank mergers and regulation are all leading to a massive need for private credit within the commercial and residential real estate sector.

The opportunities are there and we’ll keep capitalizing on them.

As usual this is not investment advice, merely boots on the ground observations from a real estate private credit specialist.

Follow Sean Kelly-Rand on LinkedIn