Now that we have a good understanding of the differences between financing from a bank or from a private lender (ICYMI, see our post here), it’s time to get into the nitty gritty with with an example.

Let’s imagine you found a fixer-upper on the market for $585,000. The bathrooms and kitchen could use a little upgrade, and you estimate that renovations will probably cost you approximately $75,000.

At what price will you have to sell the property in order to make a profit? It’s not as simple as any price over $660,000 ($585,000 + $75,000).

This is because of the time value of money, or the concept that a dollar today is more valuable than a dollar tomorrow. The less you have today, the longer it will take for you to realize returns. In other words, a project that delivers $1 million on an investment of $10 million over 12 months (1 / 10 = 0.1, or 10% per year) will have a higher IRR than a project that nets $1 million over 24 months (1 / 10 / 2 = 0.05 or 5% per year). Plus, you also have to factor in the interest payments, property taxes, and other fees you might incur for the duration of the project – otherwise known as carry costs.

Now you’re probably wondering what an IRR is. One commonly used measure for real estate investors to assess the potential profitability of a specific project is through its Internal Rate of Return, or IRR. This is a measure of a project’s rate of return, and is referred to as “internal” because it does not take external factors such as the risk-free rate, inflation, or other risks into consideration. Generally speaking, the higher a project’s IRR, the more cash flows you can expect back, and therefore the more lucrative the project, assuming risk factors stay the same.

Calculating the IRR on a project can be complicated as it requires breaking out the various components of your cash flows – such as the property price, estimated construction costs, and the funding you expect to receive – over the total time period of your project. Then, you have to calculate the discount rate at which the net present value of future cash flows of the project are equal to the initial funds required for the project. Most people typically use one of the built-in formulas in Excel to calculate the forecasted IRR, which is the method we will use here.

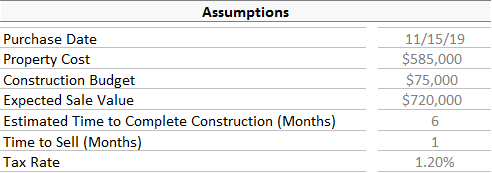

Now let’s get back to our example and see the impact of several variables on the IRR. First we’ll need to make a few assumptions, as listed in the chart below. You should be able to estimate an expected sale value by comparing similar homes on resources such as Redfin or Zillow, for example.

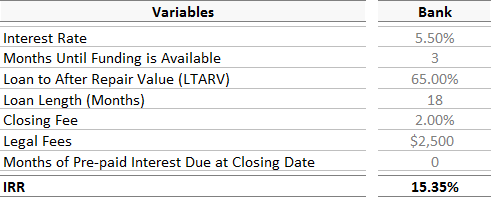

Next, we’ll have to incorporate your financing terms into the model. You go to the bank, and after reviewing your credit history, they decide that they can give you a loan at 5.5%. However, their underwriting process takes an average of three months per property. Plugging these variables into our model, we can expect an IRR of 15.35%:

Example 1: Bank Financing (expedited timeframe)

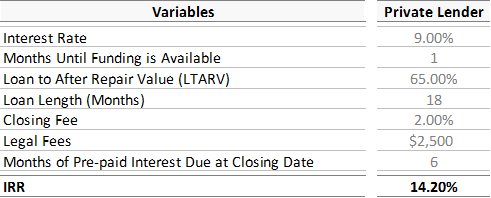

That seems pretty good! However, what if you need to close on the property right away? You speak to a private lender who can get you the funding within two weeks . . . but at an interest rate of 9%. According to our model, you can expect an IRR of 14.20%, assuming all other terms are the same as from the bank. Closing costs typically range from 2% - 5% of the home’s purchase price, and some states require you to have a real estate attorney in order to close.

Example 2: Private Lender Financing (typical time frame)

While this is not as good an IRR as you would expect from bank financing, it is still positive. Therefore, it still makes sense to move forward with the project!

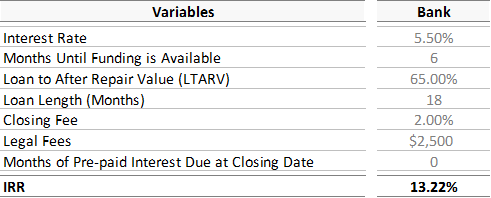

Now let’s say the bank will not be able to provide you with financing for six months. The IRR of the project will then drop to 13.22%. Also keep in mind, you have had to pay for all your costs out of pocket up until this point. So even if you own the house, you may not have the cash on hand to pay for construction, and therefore can’t make any progress on your investment.

Example 3: Bank Financing (typical timeframe)

To help illustrate how we calculate the IRR as set forth above, we have created an Excel worksheet where you can simply input a few variables about a hypothetical project, and obtain an estimated IRR. Please note that this is not intended to reflect any return that you might obtain on your next project and is for educational purposes only. Also note that you will need to download the worksheet, and will also need the latest version of Excel in order to use it.

As mentioned previously, IRR is just one measure of the success of a project. In future posts, we’ll go into further detail about other measures such as equity multiples and cash on cash returns.

Conclusion

Depending on your liquidity profile and various other factors, waiting for funding could reduce your IRR, or the overall return on your investment. As you shop for a loan for your next real estate project, it is imperative to complete a full analysis of the project and financing terms that takes the time value of money into consideration. In many instances, you will find that the value a private lender provides by furnishing funds quickly can be worth the higher interest rate.

We hope the worksheet can help you easily see this point, and we’d love to hear your comments. E-mail us at contact@rdadvisorsre.com or send us a Telegram if you have any questions. We’d be happy to help you further evaluate your financing options.