LEARN ABOUT OUR INVESTMENT VEHICLES

Insights

Resource

Alina Trigub Podcast / The Power of Passive Investing

youtube.com

Entrepreneur to Investor: How To Build Wealth Without Working More/ The Power of passive Investing.

Blog

From Lehman to Lending: Lessons from a Real Estate Insider

youtube.com

On the Ready 2 Scale podcast, Sean Kelly-Rand breaks down how he scales real estate debt strategies with a focus on resilience, structure, and sustainable growth in volatile markets.

Boston Housing Crisis: 150,000 Units Short, Zoning and Permitting Issues

Boston has the 4th largest housing deficit in the US. And its not getting better.Here is the data:1) The Greater Boston area is short over 150,000 units for its population according to zillow.2) Under 6,000 new units were estimated to be delivered in 2024 by Moodys.3) Boston metro area saw a 38% year-to-date drop through March 2025, representing the largest decline since 2008!!!Let that sink in. Greater Boston area is 150,000 units short. It is not catching up, and even slowing down. If you are a resident of the area and wondering why you housing costs so much... it's pretty clear ... it's a scarce commodity. What can be done? We need to increase production substantially. The means clearing our the barriers. Right now the biggest are IDP (inclusionary development - i.e. the requirement that developers essentially build 1 loss making affordable apartment for approximately every 4/5 profitable apartments - that essentially stops most large scale construction). And two the zoning and permitting processes have become much longer over the past few years. Takes way too long to get shovels in the ground.Good news for home owners it helps keep home prices elevated. Bad news is its more expensive rents and harder to get on the property ladder. Let's Let the Builders Build!It also means there is loads of demand for loans from RD Advisors for rehab and bridge (renovation and conversion of existing, and soon mezzanine). And significant demand for housing when its built. Follow Sean Kelly-Rand on LinkedIn

LinkedIn

There’s a reason we’re in #Boston.

linkedin.com

Sean Kelly-Rand shares why he believes this market offers more stability for lenders—from its diversified economy to the advantages of nonjudicial foreclosures.

LinkedIn

Private Credit is Eating Private Equity

Private Credit is Eating Private Equity.Good quote by CP. I certainly don’t agree with everything he says but based on what we see in our own portfolio I find that statement to hold true.And this is exactly why we (myself and the Dominion Capital Family Office) partnered on a real estate private credit strategy eight years ago. The steadier stable private credit returns were likely to eventually overrun the more volatile equity/private equity returns over a longer period of time (Howard Marks writes on this as well).And I am sure this will be a topic at Milken Institute this week and SuperReturn in June.And too CP's point if private credit grows more than the equity side (i.e. less PE capital for acquisitions), than where does the debt/credit capital go…Well, if you follow me you are well aware of the wall of maturities, a massive gap in the capital stack, and how bank mergers and regulation are all leading to a massive need for private credit within the commercial and residential real estate sector.The opportunities are there and we’ll keep capitalizing on them.As usual this is not investment advice, merely boots on the ground observations from a real estate private credit specialist.Follow Sean Kelly-Rand on LinkedIn

Resource

Sponsor Spotlight: RD Advisors

youtube.com

Get to know RD Advisors in this interview with Sean Kelly-Rand, Managing Partner. Learn about their approach, strategy, and what sets them apart.

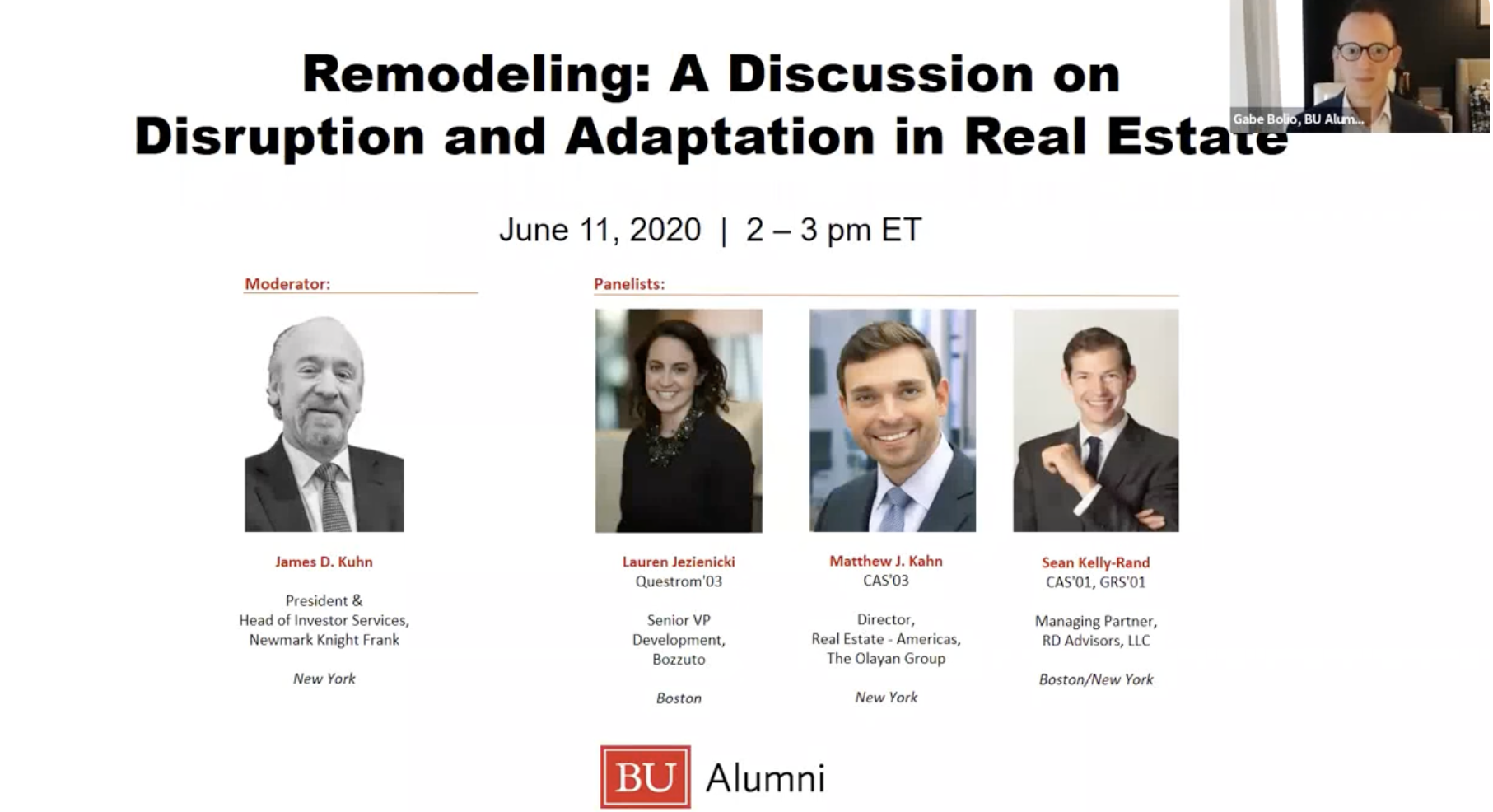

Press and Speaking Engagements

Resource

youtube.com

Hosted at BU Alumni Online, this conversation explores how innovation, shifting markets, and economic change are reshaping the real estate landscape. Join RD Advisors as they discuss what it means to adapt, evolve, and find opportunity in times of disruption.

Press

Thierry Valat De Cordova Builds a Mindful Life

modern-counsel.com

For decades, Thierry Valat De Cordova immersed himself in a high-pressure legal career. Now, through mindfulness, he is clearing the clutter to focus on living the best life possible.

Press

Reaching for the legal summit

vanguardlawmag.com

Press

Inside SuperReturn North America: How private credit and defence are reshaping investment

informaconnect.com

With banks pulling back, private credit is stepping up to fund real estate projects that might otherwise stall. Sean Kelly-Rand explains why this shift is creating new opportunities for investors and developers alike.